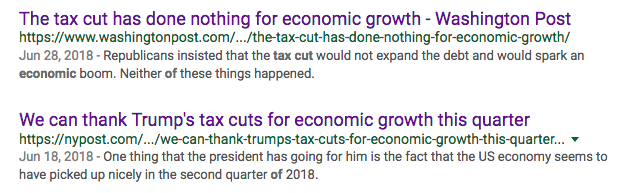

August 22 will mark the longest bull market (up market) in history unless the stock market drops more than 20% before then. It got us thinking, who deserves the credit for this? Trump helped push through the tax reform which resulted in our economy notching a 4%+ GDP growth figure in the second quarter of 2018. This is the most our economy has grown since 2014. So does Trump deserve credit for this economic growth? I Googled that question…the unhelpful results are below:

That got us thinking, should we be giving Presidents credit for economic growth? Should Coolidge get credit for the Roaring Twenties? Three months after he left, the bubble burst and Hoover took the blame for the worst performance ever. However, it sounds like the Smoot-Hawley Tariff Act he signed didn’t help matters.

It looks to me that timing may have more to do with a President’s stock market record than the policy put in place. Clinton benefited from the internet boom and George W was saddled with the internet bust, the 2001 terrorist attacks, and the 2008 crisis. Trump has benefited from the momentum of this long recovery started under Obama, but Trump should get some credit for extending it. To be clear, he’ll also get the blame when things cool off, especially if the reason is because of his tariffs.

Best Presidents stock market performance:

1. Calvin Coolidge 1923-1929: 26.1%/yr

2. Donald Trump 2017- July 25, 2018: 16.2%/yr

3. Bill Clinton 1993-2001: 15.2%/yr

4. Barack Obama 2009 – 2017: 13.8%/yr

Worst Presidents stock market performance:

1. Herbert Hoover 1929-1933: -30.8%/yr

2. George W Bush 2001-2009: -5.6%/yr

3. Grover Cleveland 1893-1897: -4.9%/yr

4. Richard Nixon 1969-1974: -3.9%/yr

In the meantime, stocks are steady and companies are reporting their earnings again. So far the news has been good (with the exception of Facebook falling over 20% tonight!), but everyone is still pointing to uncertainty surrounding the brewing trade drama. The meeting with the EU just today looks like that could be a bit of good news on the trade front.

Other economic indicators suggest the housing market may be peaking. In California, a leading indicator for the nation, June’s sales were down 11% from one year ago. Houses may now be priced too high and rising interest rates could be squeezing buyers.

The data for Portland is still good though. May saw sales slow, but June 2018 home sales beat June 2017 sales by 7.8%. There may be a slow down coming, but Portland doesn’t seem to care just yet.

Allevi-8 Book

Another item we wanted to mention is a retirement planning tool that we’re offering to our clients. We’ve had a few versions of these in the past: the When I’m Gone Book is what Bruce originally called them, then we had The Go-To Book. Now, we’re creating them here in the office and calling them the Allevi-8 Book.

These books are a place to put your important financial documents so your spouse or beneficiaries can easily find your insurance policies, investment accounts, will or trust, real estate info, important contacts and other details if/when something happens to you.

We’ve handed out 30 of these so far and we have another 20 that Jeremiah just put together. Please let us know if this is something you’d like to have, or if you have a friend or family member that could benefit from it. When we run out we’ll just make more!

Hope everyone is enjoying the summer. Call us with any questions or concerns.

-Tim Porter, CFP®