During his inauguration speech last week, President Trump said, “… the Golden Age of America begins right now…” A pretty optimistic tone, but then again maybe not surprising since he’s likely feeling pretty golden after the year he had.

I wouldn’t mind seeing the Golden Age of America. Politics aside, I bet a lot of us would like to see that.

The question is, what would need to happen for us to experience that? Since I’m not a political guy, just a financial one, I’ll stay in my lane and explore what we’d need to see for an Economic Golden Age.

If we look backwards at previous golden ages in our history, the time period closest was the 10-15 years after WWII. We defeated the enemy, came back home to build lives and families, and built an incredible economy along the way.

The growth of our economy (GDP) was around 4% back then (it is currently averaging close to 2%). Inflation was low and prices were stable. Technological advancements, like the mass production of automobiles and other machines made us into the leading industrial powerhouse of the world. Increased wages were helping everyone raise their standard of living, and this contributed to the rise of the middle class as more families were able to afford homes, cars and education.

We’ll need to see something similar for the next Golden Age. A tall order for the Golden President. Here’s our thoughts on a few specific areas:

Golden Stability – To see the Golden Age come to fruition, Trump will need to keep prices stable. High inflation, like we’ve seen the last few years, erodes American’s purchasing power and makes us feel poorer. One of Trump’s main talking points during the campaign was aimed at reducing high inflation. In his few days in office he’s signed executive orders for all departments to work towards lowering costs for all consumers. That’s a nice gesture, but those departments don’t have much control over prices.

Economists have warned tariffs could be inflationary and will raise prices. It will be difficult to both impose tariffs on imported goods, like Trump is planning to do, and lower costs for the consumer. There are other benefits of tariffs; like collecting additional taxes and targeting a particular country such as China, but the side effect may be inflationary.

One thing Trump is hanging his hat on to keep prices low is bringing down the cost of oil and gas. If he is successful and drops prices, that could help offset the inflationary pressures of the tariffs he plans to impose. All in all, I’m skeptical we can achieve this Golden Stability.

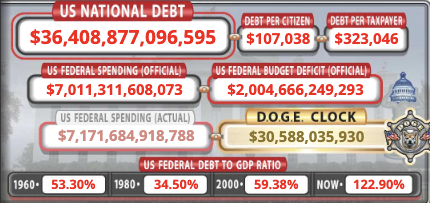

Golden Growth – The Golden Age would also need to see some Golden Growth. One area that’s helped our growth is government spending. Every dollar the government spends in the economy contributes to growth. If you take away some of this govt. spending you take away some of the growth in the economy. Unfortunately, we’ve been spending more than we make and deficit spending has gotten out of control. We make $5 Trillion per year in revenue as a country but spend $7 Trillion. That has ballooned our nation’s debt up to $36.4 Trillion today, according to the USDebtClock.org. The answer of course is to reduce government spending, but like I said, that will limit the growth of the economy.

Trump signed an executive order to create the Department of Government Efficiency (DOGE) to make these cuts. The cuts they impose will need to be significant in order to make a dent in the deficit. Other administrations have tried this. I remember being excited about how the Simpson-Boles committee was suggesting ways to balance the budget for Obama, but it never materialized. The cuts DOGE needs to make may be unpleasant and will definitely slow growth, but if we don’t take our medicine now, the problem will be worse in the future. I’m skeptical Trump can reduce government spending and increase growth significantly…without some kind of ace in the hole.

Golden Innovation – This is the ace in the hole. The only way a Golden Age happens is if innovation and technological advancements bring about new productivity and industries. Just like the innovations of electricity, steel, and assembly lines helped bring about the boom in manufacturing in the 50s, we need something similar to bring about another boom.

What’s fascinating is the new advancements in artificial intelligence (AI) could be the ace in the hole we’re looking for. AI has a potential to change a lot about how we do things in the future. I’ve been slow to believe this, but after seeing the tens of billions of dollars companies are spending on AI infrastructure the last few years, I believe! Meta announced just last week they plan to spend $65 Billion on AI related costs in 2025. The dollars are staggering.

Here’s a list of what could change as a result of AI:

1. Innovation across industries including health care, autonomous driving and financial technology.

2. Productivity increases in manufacturing, agriculture and customer service.

3. Better Predictions that help improved decision making.

4. New Industries like data science, AI development, and robotic maintenance will help replace jobs that will be automated.

5. Revitalizing Education could reduce the cost of education.

6. More use cases we haven’t even thought of yet…

The bottom line is I don’t know if we will see an Economic Golden Age the next four years, but there is one coming, and we don’t want to miss out in our portfolios.

We’ve been investing in some of the companies at the forefront of this AI race in our Growth Stock Portfolio. Some of them have seen tremendous growth due to the hope of the AI boom. However, as I write this, some of the best growth names of the last several years, and the stock market in general, are down big today. A new competitor in China, DeepSeek, has claimed they have found a new and less expensive way to develop AI.

Some are saying the AI bubble just burst, others are saying to buy now because the AI opportunity is still in the early stages. Whose right? I’m not sure. It just seems to be another example that what goes up foreverdoes eventually come down a little… right before it goes back up again. We largely stay invested through all the drama.

We’ve seen two good years in a row for stocks fueled largely by the hope of AI. Time will tell if we get a chance for a 3-peat, like my LEAST favorite team in football, the Kansas City Chiefs. Whether this AI shift and potential Golden Age happens over the next 4 years or 40, we need to be invested in it.

SMB Financial News

We grew yet again this last year! We now manage approximately $175 Million across our five advisors. With that growth comes additional work we need help with. We are once again looking to hire another admin assistant and future financial advisor to help us with these extra duties.

As I mentioned in our last email, Jeremiah and his wife Alicia are expecting yet another child to add to the brood on the right. He will be out of the office for several weeks in March after the baby is born and I will be stepping into the operations role while he’s away.

No exciting news for me and my family, other than we got to visit the Florida Keys over the New Year. I was born in the Keys and spent the first 9 years of my life down there. It was an incredible trip seeing old familiar sites (like the Tamarind tree I used to climb after baseball practice 35 years ago!), getting out on the water to snorkel, and visiting family still down there.

It was a great vacation because it helped me rest up for another year of serving our great clients. We are so grateful for the incredible relationship we have with all of you. Please don’t hesitate to contact us if you need anything. We hope to talk with everyone soon.

Thanks for reading,

Tim Porter, CFP®