Senior-Living Placement

How does someone without any assisted-living experience, 1) determine which senior living facilities are good, 2) match the needs of their loved one with the right facility and 3) not pay more than they need to? These are stressful and difficult questions that many of our clients have been faced with recently.

In our planning meetings with clients, we usually discuss the cost of long-term care, and how to cover those costs, but haven’t talked much about the practical steps to finding a home. Now we have a resource to help.

In our planning meetings with clients, we usually discuss the cost of long-term care, and how to cover those costs, but haven’t talked much about the practical steps to finding a home. Now we have a resource to help.

We were introduced to Jennifer Cook-Buman of Portland Senior Housing, who helps with Senior Placement. Calling Jennifer appears to be a good first step in the process of finding a facility. She provides a service designed to help families place their loved ones in the right home. Jennifer has extensive knowledge in our local area and has placed over 1,100 individuals. In addition, she comes highly recommended.

I met with Jennifer a few months back and one question I had for her (my favorite question) was, “How do you get paid?” She explained, the facilities have agreements to pay her after the placement, similar to how a realtor gets paid after a sale.

This puts very little burden on the family which is nice, but it can also provide a conflict of interest if she only places individuals in the homes that pay her the most. She explained the details this way, “We all have our own contracts, many are percent based on the monthly rent, I differ in that my fees are a flat rate regardless of size of apartment, location in building, etc. They’re all the same – penthouse in Taj Mahal or studio at motel 6.” This is a great model because there’s no incentive to put a family in a higher priced home unnecessarily.

After hearing about her service, I decided to pass on Jennifer’s information to everyone just in case there are others going through this same process. Feel free to contact Jennifer if she can be a help to you. We get no benefit from any referrals.

Phone: (503) 487-7245 Email: [email protected]

Financial Placement

Jennifer handles the people placement, but we help with the financial placement. We’ve been able to help a number of clients put their money in a policy, or investment, that will benefit them the most should they need care. Below are a few questions that should be asked as you consider your own situation.

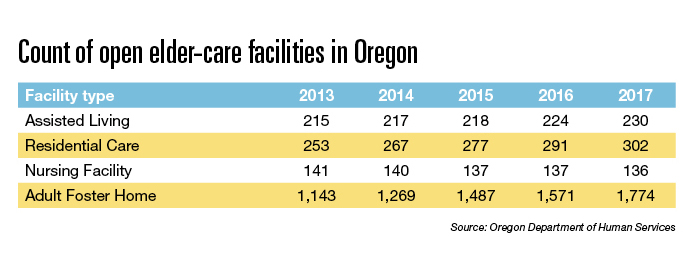

More Oregon specific information can be found in a recent article here.

How likely am I to need care?

-

-

- 70% of people over age 65 will require some care at some point.

-

-

-

- A woman turning age 56 today can expect to live, on average, until age 86.6. About one out of every four 65-year-olds will live past age 90, and one out of 10 will live past 95.

-

How much will care cost?

-

-

- $150,000 is the average cost for people needing care in Oregon. (The Mirabella facility in the South Waterfront of Portland is pictured above.

-

-

-

- $709,647 is the projected average cost for three years of long-term care 30 years from now.

-

How do people cover these costs?

1) Don’t buy insurance and self-insure. – Two-thirds of Americans do this. Most don’t have resources to self-insure.

2) Buy insurance using one of two ways – Pay as you go or Pay one time (details below).

3) Some combination of self-insure and insurance.

Pay as you go VS. Pay one time

Pay as you go – similar to car insurance, pay small monthly premiums and get paid ONLY when you need care.

Example: A couple of healthy 60-year-olds pay $280/mo and have $340,000 in benefits toward care.

Pay one time – Move a larger amount to the insurance co. and get paid one of these three ways:

1) death benefit at death,

2) benefits to help pay for care, or

3) take your premium back without interest.

Example: Someone in good health and in their early 60’s moves $50,000 to an insurance company and receives:

1) beneficiaries receive $100,000 in death benefit,

2) insured receives $100,000 in long-term care benefits, or

3) take the $50,000 back without interest.

Evaluate your own long-term care needs, or to download our 7 Deadly Sins PDF.