The snow is falling here in Portland this week and stocks are rising! Hooray! After a tough end of the year for 2018, we’re getting some relief as the stock market posted its best January since 1987. With that kind of start, we feel like it’s a great time to catch our breath and prepare for the next chapter.

We’ve already started getting calls on taxes, so we know that’s on everyone’s mind. TD Ameritrade has confirmed all tax info should be out no later than Feb 13th. If for some reason you don’t get that in the mail or lose it, please call us and we can resend it to you after that date.

The other tax news is the new tax law taking effect this year. The changes in the law will yield different results for everyone, but it appears the main benefactors of the tax cut were small business owners and corporations. The corporate tax cut was in part why the stock market was positive in 2017.

Those individuals paying a little more in taxes this year will be those who had a significant amount of itemized deductions in the past. Those have been limited to just a handful now: local taxes capped at $10,000, charitable gifts, and mortgage interest are the big ones that have been left.

With taxes in mind, we thought we’d share a tax tip for the charitable givers and a few other financial planning tips that you may want to consider:

Charitable Giving

If you are the charitable type and know you’ll be giving to a charity this year, there is something you can do to maximize your deduction – gift those dollars from an IRA.

Because the new standard deduction is $24,000 joint and $12,000 single (more if the tax payers are over 65), many people will have a hard time reducing taxes from charitable gifts. When you gift directly from your IRA, you are guaranteed to get the deduction because the distribution from the IRA will not be taxable.

This will have the effect of raising your standard deduction. Call us if you find yourself in this situation so we can help you make a good decision.

Review Risk

After such a bumpy end to the year, now is a good time to review risk tolerances to see if you would rather be more conservative, or more aggressive. No one likes to see accounts go down, but when it causes you to lose sleep it may be time for an adjustment.

Update Beneficiary Designations

This is an easy task that’s often overlooked. When that happens, it can have devastating consequences. We’d be happy to report what your current beneficiaries are and then prepare paperwork to update if necessary.

Organize Your Documents

We’ve recently been making a push to get one of our Allevi-8 Books in everyone’s hand. We’ve heard recently this book has been the catalyst people have needed to get their financial situation together so they can Allevi-8 The Hassle of organizing their estate for their loved ones. They’re available on Amazon.com (search: Allevi-8) now, but free for our clients. If you haven’t received one, please call us so we can get one to you.

SMB Financial News

This year we’ve been settling into our new office in Tigard, where we’ve been for just over a year now. We especially enjoy rolling the Traeger grill out of our garage door and grilling salmon and tri-tip for client lunches. We did this probably 20 times last year. If you haven’t had the chance to come in for lunch, please ask! We love to do it.

Our most recent hire, Jeremiah Forrister, has been with us about a year and a half now and is doing a fantastic job! I’m not sure how we functioned without him. He’s been the lead on administration details and he’s also a licensed advisor looking to grow his own book of clients.

He and his wife also just celebrated their third child, Willow Forrister, last August.

Please congratulate him next time you call in if you haven’t already!

Brian Bradley has now been a part of SMB for four and a half years and he continues to become a vital part of the operations of the firm. Brian has been extremely helpful in putting together complicated financial plans and helping me tackle high level operational tasks that come up. This has made him an invaluable asset to the team.

One thing Brian is celebrating this year is NO MORE KIDS! Brian had his fourth girl, Opal Bradley, a year and half ago and he’s looking forward to keeping the family that size.

Bruce has had a busy year! On September 16, 2018 Bruce married Maiza Fatureto, who is originally from Brazil. They were married in Ashland, OR with a group of friends from Bruce’s flying club. Please congratulate Bruce when you talk with him.

Bruce has also begun to sell some of his half of the business to me (Tim). Ownership now stands at 60% Tim/40% Bruce. With that change Bruce will be in the office less, but has no plans to retire.

Finally, Holly and I (Tim) haven’t had many life changing events this year, but the family is still growing like a weed. Henry (7) is in first grade now and is a champion at math. Lucy (5) started preschool and amazed Holly and I with how quickly and easily she took to it. Penny is now two and a half and is the most gregarious of the three. Our favorite part of watching Penny is when she tries to boss her two older siblings around. It’s hilarious.

The business really has been the thing that’s kept me busy this year. As I step further into the lead role, we’ve been blessed with multiple partnerships that have been incredibly fruitful for us.

We continue to manage money for the Oregon Trial Lawyers Association, and we’re setting up retirement plans for the 1,100 attorneys and firms that are a part of that group. We started a relationship with KaiPerm Credit Union this year and are handling their member’s financial planning and investing needs. That’s led to meetings at each Kaiser Permanente facility here in town, where we do the 7 Deadly Sins of Retirement presentation and have begun to meet with retiring Kaiser employees looking for help with their finances.

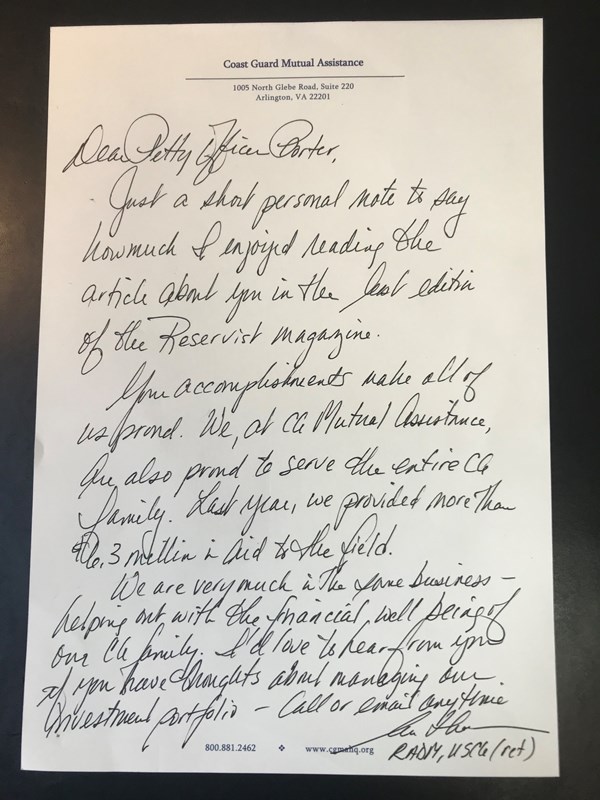

Finally, after winning the Enlisted Person of the Year award for the Coast Guard last year, I received a handwritten letter (above) from a retired Admiral to see if I could help the Coast Guard manage their $30 million portfolio! This is a phenomenal opportunity and I’m still working to see how I can assist them, but just the request was such an honor. I’ll keep everyone posted if I make any headway on this.

Needless to say, this has been a busy year and we are so excited for the future of our firm. Thank you for being with us and helping make it so special. We have the best clients of any firm and we love the great relationship we get to have with each one of you.

As always, please let us know if there’s anything we can help you with.

Thanks for reading,

– Bruce Porter & Tim Porter, CFP®