One month ago I reported the stock market’s 10% drop from Oct 1st was Not That Interesting. Then, the market dropped an additional 10% bottoming on Christmas Eve for a total of 20% pullback. Ok, now it’s getting interesting! A 20% pullback has only happened three times since I’ve been in the business.

Meanwhile, the financial media’s worked itself into a frenzy trying to find the most crisis-like headlines to capture more viewers….

WORST CHRISTMAS EVE IN 40 YEARS!!!

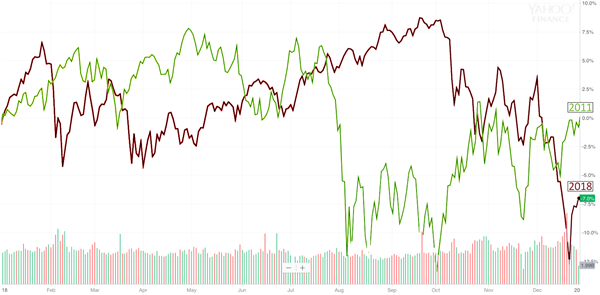

WORST MARKET SINCE 2011!!!

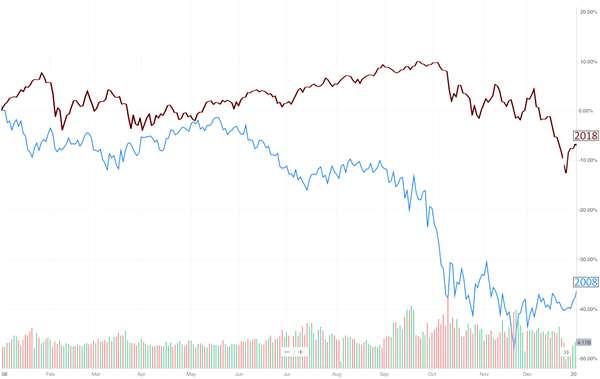

WORST MONTH SINCE 2008!!!

(see charts for comparisons)

The only problem? There’s no crisis.

Rising interest rates are perfectly normal for this point in the business cycle, slightly slower growth of the economy is no crisis, and the slowing demand for housing is actually healthy.

This overreaction to normal events reminds us of some timeless words, “There is a time for everything and a season for every activity under the heavens…a time to plant and a time to uproot…a time to tear down and time to build…a time to weep and a time to dance…a time to keep and a time to throw away…a time for love and a time to hate.” These words are from the Old Testament Ecclesiastes 3:1-8 written into a Pete Seeger song from the 50’s, and popularized by The Byrds in 1965.

Approaching New Year’s Eve we can identify with these themes: planting investments and uprooting others—keeping some and throwing away others—some caused weeping others caused dancing—some investments we loved, others we hated.

Just to be clear, we still have concerns. Namely the stability and the predictability on the part of Washington. Many are now wondering what our principles, priorities, and policies are, and how we arrive at them. Changes usually debated publicly and signaled in advance are sprung on the world. This new style excited investors two years ago, but may now be causing exhaustion.

Regardless of the concerns, there are always risks to investing. Although all our statements will show a negative next month, one comforting thought is after every 20% downturn I’ve been through in the last 13+ years (2008, 2011 and 2018) comes a bounce. Whether it takes 3 months or three years, the last three downturns I’ve witnessed have been wonderful buying opportunities. This is why we keep buying when investments go down.

Here’s a breakdown of the buys we’ve made after the market started down:

For the growth stock portfolio, we bought Fortinet FTNT a cybersecurity company, made an additional buy in Square SQ the payment processor, and sold at a gain and rebought lower Mercadolibre MELI the South American Amazon.

For the Moderate and Conservative portfolios we bought First Trust Internet Fund FDN and after a 15% pullback in the market, we bought the high-income Pimco Dynamic Income Fund PDI.

We’re confident these will be good buys as the market trends higher, however, if it turns negative again, we have cash for an additional buy in each of the portfolios.

We hope you have a wonderful New Years and look forward to seeing you in 2019!

– Bruce Porter & Tim Porter, CFP®