Thanks to Tony Robbins we all know about the power of positive thinking, but before Tony, came Watty Piper. It’s thanks to Watty 100 years ago and his Little Engine That Could that we often think optimism and positivity is what we need to be successful.

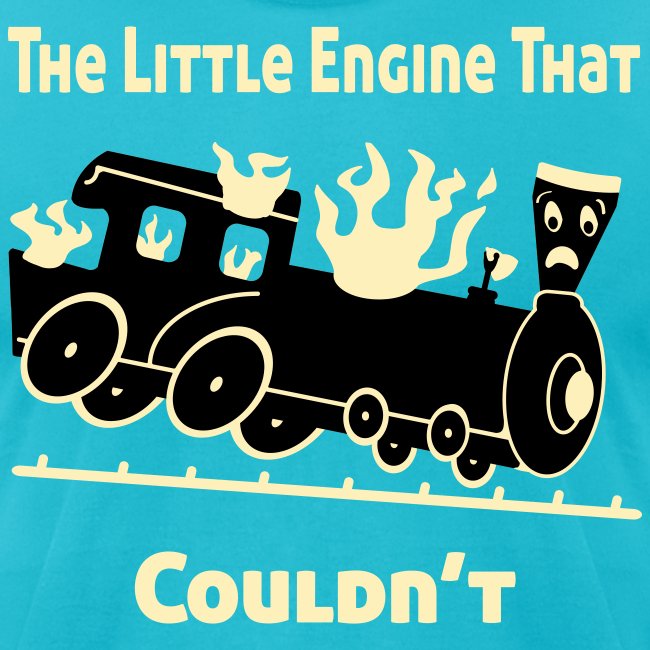

But what about the Little Engine That Couldn’t? Did that train plagued with worry, fear, and pessimism make it over the hill? Based on the picture I found, it doesn’t look good.

So how about the Little Economy That Couldn’t? What happens when negativity and pessimism take over? Can that derail an economy and stock market?

Right now our economy is trying to get over the hump of a potential slow down from rising interest rates. Optimism is hard to find, the economic outlook is unclear, and the financial news is as pessimistic as ever, repeating “I think we can’t…avoid a recession, I think we can’t…avoid a recession.”

Self-fulfilling Recession

Our economy is based on consumer confidence. If people are confident they’ll earn income, they will SPEND, taking care of themselves and their families and investing in their future. This helps the overall economy grow. If they don’t have confidence, they won’t spend but will instead SAVE, just in case they lose their job. So, the fear of a recession can actually create a recession, or make a one much worse.

Fear Turns to Hope

As of this moment, it appears a majority of people believe we will be, or are already, in a recession. A Forbes article in January said, “This is the most anticipated recession ever.” This is increasing the likelihood we’ll enter into a recession in 2023.

This is concerning, but not surprising. This is the process during EVERY slow down. This is the process of life. Pessimism reigns until it doesn’t. Fear is a powerful feeling until it turns to hope.

But as long-term investors, do we care?

As long-term investors, we’re less interested in the mood of the economy. We care about facts, not feelings, when we plan our investment strategy. We care about the Little Economy That Did. What did the economy DO?

So far, the pessimistic predictions have not come true. The data is showing inflation has been coming down, consumers did not close their wallets, and earnings reports for companies have not been too bad. It turns out the economy is not as fragile as most thought. We’re once again glad we don’t make large changes based on emotion.

Emotional vs Fundamental

Emotional swings are typically short term, but fundamental moves based on inflation data, GDP, unemployment, retail sales… are longer term. We care more about the fundamentals of the economy and less about the emotions.

This is why we try not to get overly excited when things go up, and this is why we were not overly pessimistic last year when things went down. Instead of making major moves, we tweak portfolios or simply hold steady during emotional swings. Below is an overview of some tweaks we’ve made to portfolios after a tumultuous year.

Portfolios

We have 3 main components we invest in for clients depending on risk: Guarantees, Moderate Funds, and Growth Stocks

Guarantees – These are products from banks or insurance companies that are some of the safest vehicles we invest in. We’ve seen the rates on these guarantees jump this year. We have been, and will continue to, incorporate these into portfolios as rates continue to rise.

Moderate Funds – Starting in September of last year we’ve started incorporating Buffered Funds into this portion of the portfolios. According to ETF.com this category of fund is growing quickly because they help provide downside protection and upside participation in the stock market. These are great for retirees who want less risk than a portfolio of only stocks. A few different companies offer these funds but we’ve chosen to work with First Trust, a company we know and respect.

We’re also seeing money market funds paying a more reasonable rate of interest now that rates are higher. We’ve been buying these money markets with cash that clients have on the sidelines waiting to be invested.

Growth Stocks – These more aggressive growth stocks were hit hardest last year but have bounced significantly this year. We’ve been slow to buy additional stocks in these accounts as we wait to see if the pessimistic prognosticators are right, and the stock market drops significantly. A larger portion than usual is sitting in money market funds in these accounts as we wait.

Schwab Transition

Finally, we have an update on a long standing merger between TD Ameritrade and Charles Schwab. This year over the Labor Day weekend, all of our TD Ameritrade accounts will be changing to Charles Schwab accounts.

This has been in the works for two years now, and it doesn’t appear there will be anything that clients will have to do. There will be no paperwork or signatures required, just notices that will go out this summer informing everyone of the merger. More information can be found at the website welcome.Schwab.com

We are expecting Charles Schwab to be an outstanding custodian, similar to how TD Ameritrade has been. In 2010 when we started our firm we interviewed Charles Schwab to work with them, but TD Ameritrade worked a little harder to earn our business. Thirteen years later and $130 Million in more assets, we are looking forward to the larger Schwab and the greater resources they should have for a firm like ours.

Clients shouldn’t notice much difference between TD Ameritrade and Charles Schwab. A new logo on the statement, and a different website to check balances, but other than that not much more that would affect the client experience. The bigger difference will be from our perspective as we work with a new back office to manage the day-to-day details of managing assets for clients.

As always, we appreciate the relationships we have with our clients and encourage you to contact us if you have any questions or there’s anything we can do for you. If we don’t hear from you, we’ll be reaching out to clients again around tax time to check-in.

Thanks for reading,

Tim Porter, CFP®