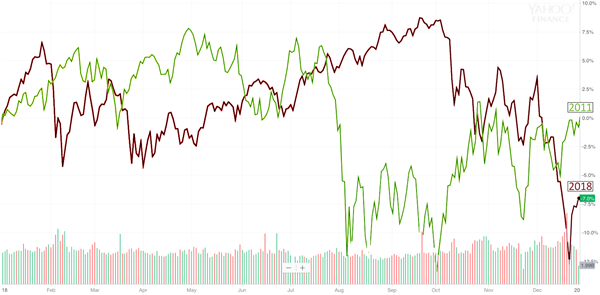

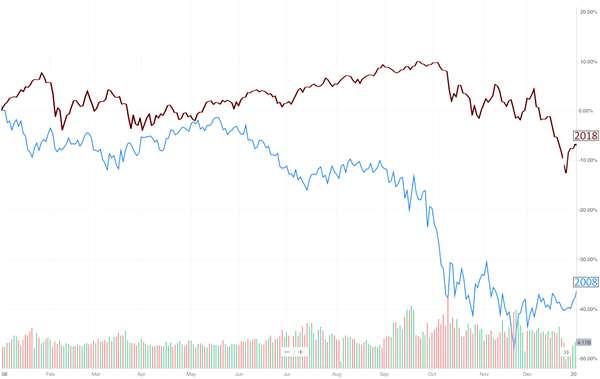

Just a note to report some good news! Yes, I said good news. I wrote three emails/blogs in December warning everyone about how ugly the stock market was and I’m desperate to report some good news. So far in the six trading days this year the S&P 500 has gained back 3.4% of the -9% it lost in December.

This is important for those folks who are just getting their investment statements from last month. While your totals will be down, things are already headed back in a positive direction. Depending on the portfolio, some accounts have already recovered half the losses of December.

We’re still a long way off the top, and it’s too early to sound the “all clear” alarm, but it’s nice to report we’re on the rebound.

See chart below for the Dec 1 – Jan 9 performance of S&P 500

As we watch political chaos and dueling partisan broadcasts from Washington it’s natural to ask how will this affect me this next year?

Bank of America Merrill Lynch says this, “The best stock market returns occur when Washington, D.C., is locked in the ‘gridlock’ that comes with different parties controlling the two houses of Congress…The best S&P 500 returns under a Republican president occurred while Congress was split, with that scenario producing 12 percent annual returns.”

Let’s hope they’re right.

Bob Doll, CFA from Nuveen investments is someone else we’ve been watching closely for the last few years. He usually has some good insight into the year ahead (8 for 10 in last year’s predictions).

“The biggest question for markets is whether the U.S. is heading into a recession,” writes Doll. “Recessions are inevitable, but we think one is unlikely to commence in 2019. If we’re right, equities will probably see gains over the next 12 months. If we’re wrong, it will be a tough year for the markets and for our predictions.”

In either case, Doll expects “markets will remain choppy and frustrating and stocks will bounce around with extended runs and declines,” not unlike the stock market’s performance in recent months.

Doll’s 2019 Predictions (click for article):

1. Economic Expansion Continues – The U.S. expansion becomes the longest in history despite GDP slowing to a still-above-trend increase of 2% to 2.5%.

2. Higher Wages – Unemployment bottoms in 2019 while wage growth continues to rise.

3. Wider Credit Spreads – The Treasury yield curve flattens and credit spreads widen due to late cycle concerns.

4. Earnings Growth? – Corporate earnings growth estimates weaken for 2019 and 2020 as both revenue and profit pressures rise.

5. Stocks Get Positive – U.S. equities experience a positive return (predicting about +8.5% return for 2019) but fail to reach record highs for the first time in 10 years.

6. International Stocks Beat US Stocks – Non-U.S. stocks outperform U.S. stocks as the dollar sags.

7. Sector Breakdown – The information technology, financial and healthcare sectors outperform utilities, REITs and materials.

8. Federal Deficit Sets a Record – The annual federal budget deficit approaches $1 trillion, a level unprecedented absent a recession.

9. Geopolitics – U.S. and global politics spark more market volatility as the cold wars within the U.S. and with China persist.

10. Dems Scramble to Take on Trump – A double-digit number of Democrats run for president, while President Donald Trump is challenged within his own party.

– Bruce Porter & Tim Porter, CFP®

can be. Just a change in mood has been enough to erase most the gains in our growth portfolio this year.

can be. Just a change in mood has been enough to erase most the gains in our growth portfolio this year.