July statements of investment accounts are the best we’ve seen! The S&P 500 stock market peaked on July 26th at approximately 3,027, which is an all-time high. Hooray! However, since then, the market has pulled back some 6%, half of that just today. Can you guess the reason? Trump’s trade war with China.

The President didn’t like the direction of the trade talks last week so he slapped a few more tariffs on our Chinese trading partners until it gets worked out. China’s response? They lowered/manipulated their currency more than ever this morning, which the stock market sees as an escalation in the trade conflict.

This never-ending trade drama continues to be a thorn in the side of the economy and stock market. Bloomberg reported that households are paying $850 more per year on goods from China due to existing tariffs and $350 more will be paid on the tariffs just announced.

Peter Navarro, trade adviser to the President, says it’s “false” that US consumers are bearing the cost. Navarro went on to say on Sunday that China must stop doing these “Seven Deadly Sins” before a new trade agreement can be reached and the tariffs are lifted on Chinese goods imported into our nation.

“Stop stealing our intellectual property, stop forcing technology transfers, stop hacking our computers, stop dumping into our markets and putting our companies out of business, stop state-owned enterprises from heavy subsidies, stop the [importation of] fentanyl [and] stop the currency manipulation,” Navarro told host Chris Wallace on “Fox News Sunday.”

All these issues would be great to resolve, but it may be wishful thinking to think we can tackle them all. We’re concerned the Chinese culture values pride and honor so much so that it won’t allow the leaders of China to be pushed around by our nation into a deal. Even if they wanted to make a deal, they couldn’t because they would end up looking weak and lose the respect of their people.

So, regardless of your opinion of the trade war, we may be living in a world of higher-priced Chinese products until either we get a different direction in the White House, or our companies move manufacturing outside of China.

Portfolios

Portfolios have only had minor changes in the last few months as markets have headed up. Now that we’ve reached a peak and started another decline this last week, we’re interested once again in investing more cash.

Just last week, in our Growth Stock portfolio, we took a scary headline that pushed the online college Grand Canyon Education LOPE down 15% and used that opportunity to buy more shares. We expect this stock to head higher again, and once it does, we will sell the extra shares we purchased.

The Moderate Funds portfolio still has cash from selling the FIrst Trust Internet Fund FDN a few months ago and we look forward to putting that money back to work in a similar fund once we get a more significant pullback.

Summer

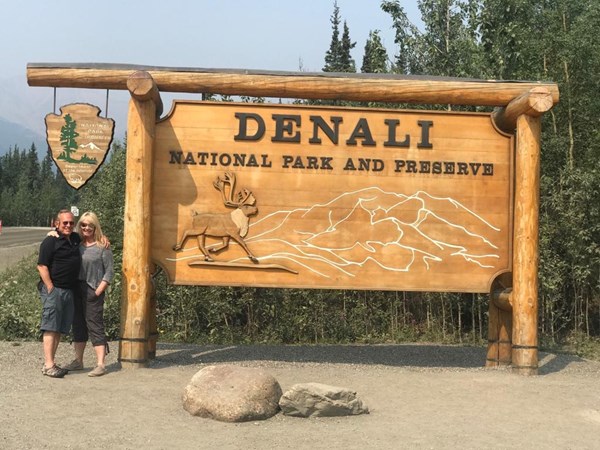

Summer has been busy for all of us here as I’m sure it’s been for everyone. Bruce has been busy traveling to Canada in June to visit relatives and to Denali, Alaska last month.

This last weekend marks Jeremiah’s third camping trip this summer with THREE KIDS UNDER THREE YEARS OLD! He’s also looking forward to a trip to California later this summer.

I (Tim) spent some time at the Coast Guard driving boats in Newport and also at a leadership training class in Seattle. My family and I spent a week in Sunriver and I also took my two oldest kids to Three Fingered Jack on a two-night backpacking trip a week ago. My daughter Lucy caught her first fish and my son honed his skills as a seasoned fisherman.

The end of this week Bruce will be flying us to Ashland, OR to hang out with a few hundred attorneys at the annual Oregon Trial Lawyers Association Convention. We’ve been managing investments for the 1200 member association going on 4 years now.

Later in August/September, we’ll continue to crank out our “7 Sins of Retirement Planning” presentations in Salem, Vancouver, and Eugene with Kaiser Permanente. We’ve done over 20 presentations now and all have been very well received and resulted in a significant number of people using us to help them plan their retirement. We’re continually amazed at how genuinely great the people at Kaiser are. We’re thankful for the opportunity through KaiPerm Credit Union to get to work with them.

Please let us know if there’s anything we can do for you. Regardless of where we’re at, we’ll have people in the office to take calls and respond to emails.

Have a great rest of your summer!