Did you hear about the economist that predicted 10 of the last 5 recessions? Well, everyone’s an economist these days with the constant talk of the next dreaded recession. Today we’d like to give some perspective on the topic.

Recessions are as normal to the economy as Winter is to the weather. Every year we know the sun will be replaced with rain and heat with cold. Although a little depressing right now knowing the sun will soon be harder to come by, Winter is perfectly normal. I just need a few more weeks to finish my projects!

Recessions are a little depressing as well. When the economy slows, growth in stocks will be harder to come by. The good news is they don’t happen every year and they don’t last forever. The common definition of a recession: when the economy stops growing and starts shrinking.

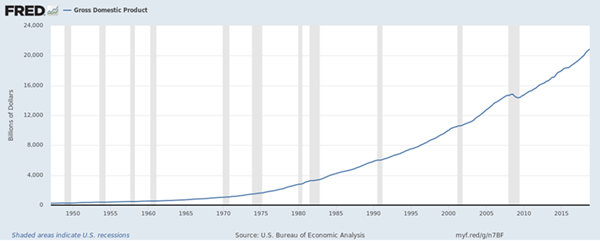

Since 1950 our country has gone through 11 recessions lasting on average 11 months in length (see image). This means the sunny days in the economy darken every 6 or so years but have always been followed by more sunshine.

A few of reasons for the obsession this time around: 1) the inverted yield curve (now uninverted) which has been a predictor of recessions in the past, 2) the unusually long period of time since, and the severity of, the last recession in 2009 – which we don’t expect to repeat by the way, and 3) the uncertainty in the global economy from Europe (Germany is already in recession) to China.

The bottom line is we’re certain a recession IS coming in the future, just like I’m certain Winter is coming. The only thing we’re not certain of? Timing. I’m better at predicting the timing of Winter.

To prep for the inevitable slow down, we’ve been trimming some winners, buying investments that should hold up better in a recession and making sure we have plenty of cash to take advantage of the next pullback.

Growth Stocks

Last month we made a few trades in our more aggressive Growth Stock portfolio. We purchased additional shares of Grand Canyon Education LOPE on a headline-driven pullback and then sold once the shares came back up approximately 19%. We also sold Cooper COO, a contact lens business for a gain because we thought it was too overvalued. We used the proceeds of the Cooper sale to fund a position in Silver SLV which is up approximately 10% so far.

Moderate Funds

In the Moderate Funds portfolio, we purchased an investment in Silver SLV for everyone’s account. We bought this investment because Silver and Gold typically do well when interest rates plunge, as they have, and it also does well in uncertain times. One big buy we’d like to make if the market pulls back is in Vanguard’s Global Wellington Fund VGWAX. The Wellington funds are some of Vanguard’s best and have a good 90-year track record.

Conservative

For conservative clients, we still like the Lincoln investment that currently pays either: 3.2% for 5 years OR a gain of up to 7% if the stock market grows or a gain of 0% if the market falls. We also have options that can guarantee income in retirement for those that are interested. Please contact us in you’re interested.

Final Thought

While we do expect another recession someday, there is very little data pointing to a slow down in the next 12 months. Unemployment is near record lows, interest rates are low, and our economy is still growing around 2% per year. But when it does show up, we don’t expect to repeat the severity of 2008-9. That was an unusually deep downturn that was comparable to the wheels coming off the financial system. Instead, our expectation is for something with less declines in the accounts and less overall pain for our clients.

Thank you for taking the time to read. Please let us know if there’s anything we can do to help.

– Bruce Porter & Tim Porter, CFP®