Entering fall is always a tumultuous time in the stock market. September and October are historically the most volatile months of the year. Now that September is behind us we see that our Growth Stocks portfolio was down last month a couple of percent, but our Moderate Funds portfolio bucked the trend and ended higher by a few percent. Both are up considerably for the year.

Looking ahead to October, we have some significant financial news happening this week. China and the US are meeting AGAIN to try and hash out a trade agreement. There’s not much optimism a deal will get done so there’s significant upside to the accounts if we get a surprise compromise. If there’s no deal or no path to a deal, there will likely be some volatility as we find out what the next round of tariffs will include.

We’re handling the uncertainty by being prepared for both scenarios. We have significant cash in our portfolios to invest and take advantage in case the market drops, but if we get a surprise agreement, the accounts are mostly invested to capitalize on an upmarket. We’ll have to wait and see how the trade meetings go to determine our next steps.

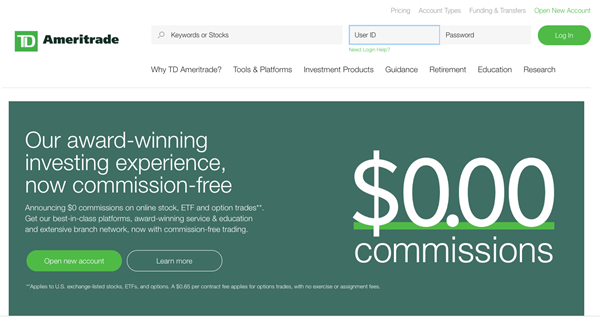

Other news last week was about trade fees. The brokerage industry is now in a race to zero for stock trading fees. This industry is mostly controlled by Schwab, TD Ameritrade, Fidelity, and ETrade. They had all cut their fees to between $5-$7 per trade a few years ago, but just last week Schwab announced they are cutting their fees to $0 per stock trade.

Thankfully, TD Ameritrade followed suit, so now there are no stock trade fees for any of our clients. Hooray! These weren’t large costs because we don’t trade all that much, but it represents reduced cost to us and our clients which is always welcome. I should point out there are still mutual fund trading fees, however, these are a small portion, like < 10% of our Moderate Funds portfolio.

Since we’re starting a new quarter, earnings season is kicking off and we’re hopeful the companies of the stocks we’re investing in will have better than expected earnings to report. We also stand ready to take advantage if the market pulls back and gives us some opportunities if we get bad trade news. As always, we’ll report back at the end of the month and let you know how things turned out.

Thanks for taking the time to read! Please call or email if we can do anything for you!

– Bruce Porter & Tim Porter, CFP®