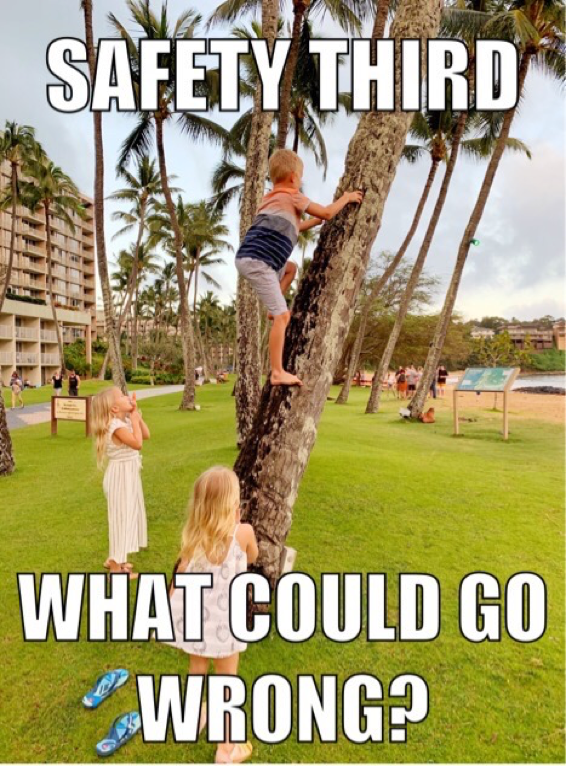

What should we make of a stock market at all-time highs and priced for perfection? After a nice run in 2019, it appears many investors are taking the Safety Third approach. This investment approach replaces the mantra of “safety first” with “risk and return first”, and asks, “What could possibly go wrong?”

Like my son Henry trying to impress his sisters by climbing to the top of this palm tree on our vacation to Kauai over the New Year. Safety was not his top priority, getting to the top was. Safety was definitely third. When he got a little higher he asks, “Dad, now catch me.” To which I replied the classic dad line, “you got yourself up there, you can get yourself down.” A few scrapes later he was down.

Now that we’re this high in the stock market – DOW hit 29,000 this week – let’s talk about how we’ll get down.

To be clear I’m not predicting a selloff, there are many good things happening in the economy right now – low employment, a Federal Reserve sitting out this year, no recession warnings from companies, and a trade war that’s on pause. It would be foolish not to consider that the party will end at some point. There will be some news that will at least temporarily push the market down.

When the news is ugly and the market is down, we try to keep our fearful emotions in check by not selling at the bottom. Instead we try and buy because things are never as bad as the news portrays.

When times are good and market is up, like it was this last year, we try to keep our greedy emotions in check by not buying at the top. Instead we sell because things are not usually as good as the stock market is trying to tell us. Greenspan called this phenomenon “Irrational Exuberance” in 1996. Right now, the stock market is telling us there’s no bad news in sight. We’re a little skeptical of that.

On that same trip to Kauai with my family, I was slightly concerned the Christmas gift Kim Jong Un, the North Korean leader, promised to send our country was going to be missiles to Hawaii. Thankfully, that didn’t materialize. Instead, we started trading missiles with Iran. The stock market shook those headlines off pretty quickly but it just goes to show I cannot predict the bad news, only that it’s coming.

To keep greed in check and anticipate the bad news that will eventually shake up investors, retirees, and those soon to be, should prioritize safety by getting a little more defensive mentally and financially:

1. Lower Expectations – Returns have been good the last year and decade, but are not likely to be as good in the next. Starting at a significant low point in the stock market as we did one year ago and in 2010, it’s easier to have good returns. Starting this decade at all-time highs, it will be harder to notch such good returns. Throw in high debts, high deficits, and aging demographics and we have an uphill battle.

2. Investment Accounts – Prioritize safety again in investments by taking gains and moving some stocks into cash and short-term bonds. This will help cushion the next fall in your accounts and provide extra ammunition to invest in stocks at emotionally low prices in the future. We’ve already been doing this in our client accounts.

3. Guaranteed Income – Make sure that you have guaranteed income (pension income, social security, or annuity) to cover basic necessities like housing, food, transportation and utilities in retirement. This will help put your mind at ease that a down market won’t wreck your retirement.

SMB Financial News

This year we’ve been loving our new office in Tigard, where we’ve been for two years now. We especially enjoy rolling the Traeger grill out of our garage door and grilling salmon and tri-tip for client lunches. We did this probably 30 times last year. If you haven’t had the chance to come in for lunch, please ask! We love to do it.

Jeremiah Forrister, has been with us two and a half years now and is doing a fantastic job! I’m not sure how we functioned without him. He’s in charge of operations in the office and he’s also a licensed advisor looking to grow his own book of clients.

Bruce and wife Maiza, have enjoyed traveling this year and are looking forward to more travels throughout 2020. Bruce also wanted to mention we had a fantastic time at my house for Christmas where all four of his sons got a chance to be loud and obnoxious together once again.

Finally, Holly and I haven’t had any major life changes this year, but the family is still growing like a weed. Henry is in second grade now and just started basketball. Lucy started Kindergarten this year and just performed in the Nutcracker ballet. Penny is now three and a half and is the mascot of our family, being crazy and having fun at all times.

The business has been growing as well. We now have seven advisors at the firm and are managing $117 Million in assets. Because we’re now over $100 Million, we had to move our registration from the state of Oregon to the Securities and Exchange Commission (SEC) this year.

Our partnership with KaiPerm Credit Union has blessed us with the opportunity to do 40 presentations so far at Kaiser Permanente facilities around Portland, Salem and Vancouver. We expect those to continue and be a big part of our growth for the future.

An opportunity I’m still working on is with the Coast Guard. As a reservist with the CG, I see the desperate need that all the young guys and gals have for good financial advice. I’ve made some inroads with some folks at the top but still haven’t found the right fit for me or my firm to provide that advice…yet. I’m hoping to make some headway in this area in 2020.

Needless to say, this has been a busy year and we are very excited for the future of our firm. Thank you for being with us and helping make it special. We enjoy the great relationships we get to have with each one of you.

As always, please let us know if there’s anything we can help you with.

Thanks for reading,

Bruce Porter & Tim Porter, CFP®