What a difference a year makes! Typically I (Tim) try to write one blog a month. This is usually enough to keep you updated about the stock market and important financial matters. Last December the news and markets were so negative, I felt like I needed to write three!

1. I told everyone the downturn we were in was Not That Interesting,

2. Pointed to a JP Morgan prediction of a significant rebound (that turned out to be accurate) in Looking for Good News, and

3. Then called it a Crisis Without a Crisis and detailed the buys we made during the pullback anticipating a rebound.

To be perfectly honest, it’s no fun watching accounts pull back like they did last year. During our Christmas Eve family get together, it was real work to put a smile on. When I try to reassure everyone with those letters, believe me, I’m writing as much to myself as I am to you.

But as you’ve seen on your statements, it paid to not panic, to take the long-term view, and to even have the guts to buy when everyone else is selling. So congratulations for a great year of investing! Let’s enjoy this nice run, but also remember, with a new year will come new challenges.

Looking ahead to 2020, we want to hear from the stock market optimists (the Bulls) and the pessimists (the Bears).

Bull Case

JP Morgan, the same strategists who called the runup this year is back at it. They see stocks 8% higher this time next year and the S&P ending 2020 at 3,400. They cite low inflation and continued low interest rates as the reason, even with uncertainty surrounding the trade war. They point out the large gains this year (about 25% year-to-date) despite the trade headline dominating the headlines.

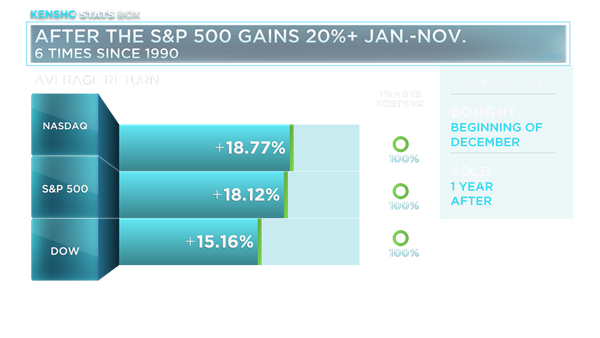

Here’s an interesting stat: 6 times since 1990, the year following a 20% gain in stocks, the market has responded with an 18% gain on average. Will it happen a seventh time or will it be different this time?

Bear Case

Not so fast, says Ben Levisohn at Barrons.com. Recession is around the corner and no one should get too comfortable. While the economy is growing, it’s not growing enough to weather a financial shock to the economy.

He states, “Even many bulls would agree that an unexpected event that would simply ding an economy growing at 3% to 4% could force one growing at 1% to 2% into recession” – think a deepening trade war or a 2020 election result that disappoints the stock market.

Our Portfolios

To prepare for either case, we’ve gotten a little more conservative in all our accounts. In the Growth Stock portfolio, we’ve taken some gains by selling a few stocks and invested those proceeds in the more stable First Trust Short Maturity FTSM which yields 2.4%/yr. This will help cushion the next pullback and give us some ammunition to buy during the next surprise headline.

We’re also more conservative in our Moderate Low-Cost Funds portfolio by having only 60% or less in stocks right now, while we wait for a pullback in the stock market to buy the Vanguard Global Wellington Fund VGWAX.

We hope everyone has an incredible holiday! In between festivities, myself and the team will be in the office reaching out to clients and wrapping up year-end details like Required Minimum Distributions. Please get ahold of us if we can do anything for you.

Merry Christmas and Happy New Year!

– Bruce Porter & Tim Porter, CFP®